Taxes are an inevitable part of life, regardless of where you choose to live. In Japan, you will mostly have to concern yourself with three types: the consumption tax (消費税, shouhizei), the resident tax (住民税, juuminzei) and the income tax (所得税, shotokuzei). The income tax is usually deducted from your salary every month by your employer. At the end of each calendar year (or at the end of your employment) the employer hands you a piece of paper called “withholding tax slip” (源泉徴収票, gensenchoshuhyou). This is necessary when you file your taxes in spring (確定申告, kakuteishinkoku). The only problem is, the gensenchoshuhyou is all in Japanese! But don’t worry, I have you covered! Read on for a simple guide to reading the Japanese withholding tax slip.

What is gensenchoshuhyou

Gensenchoshuhyou (源泉徴収票) is also known in English as the “withholding tax slip” or the “tax withholding at source certificate” depending on your preferred translation. It is a document prepared by your employer certifying your income from that employer over the last calendar year or from January to the end of your employment, if you quit before December of the same year. The document proves how much the employer deducted from your salary towards the income tax, the resident tax, and the social insurance premiums (pensions, health insurance, etc.).

How can I get a tax withholding slip?

Your employer should give you the tax withholding slip for the last calendar year around the end of December of that year or in January next year, depending on when the salary calculation for December is complete. Some companies send the gensenchoshuhyou by regular mail or by email, while others would hand you a printed copy.

If you quit before December, it is best to request a gensenchoshuhyou from your employer. While some companies would just automatically prepare the document for you as part of the resignation procedure, most will wait for you to ask. If in doubt, send an email to your employer’s HR department.

If during one calendar year you were working for more than one employer, you should receive a corresponding withholding tax slip from each of them. If you don’t have one (or can’t find them!) you can always request that the employer gives you a new copy. They will do that not only for the current (most recently finished) calendar year but also for past years, if necessary.

Employers do not charge for making a gensenchoshuhyou. However, depending on the company you are dealing with, they may charge for sending it to you by mail or courier. Especially if you need it sent abroad!

How to read gensenchoshuhyou?

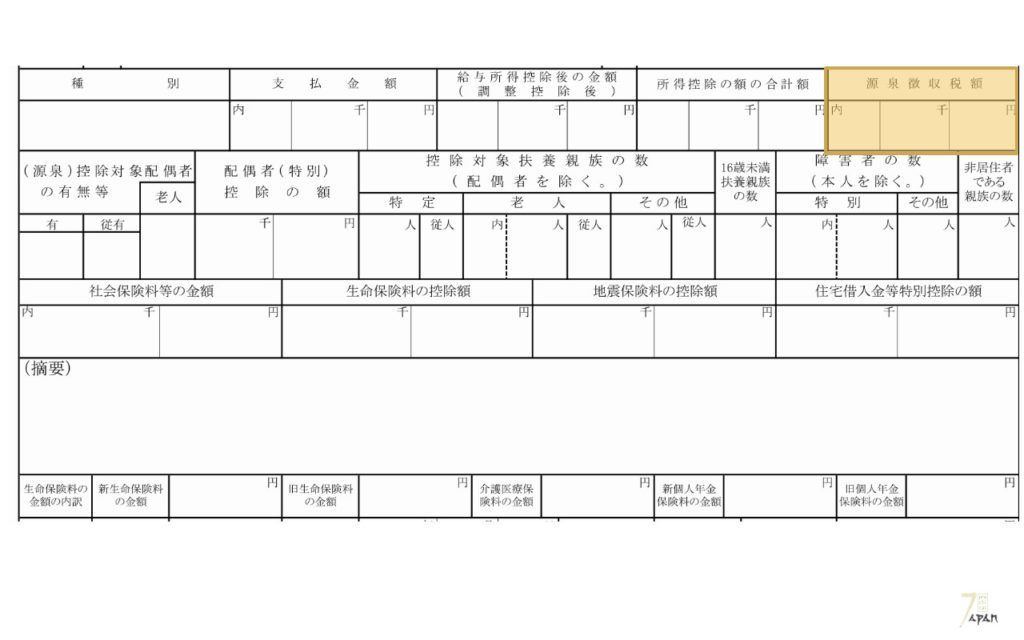

How to decipher all the useful information contained in your gensenchoshuhyou? Let’s take a look at all the major sections:

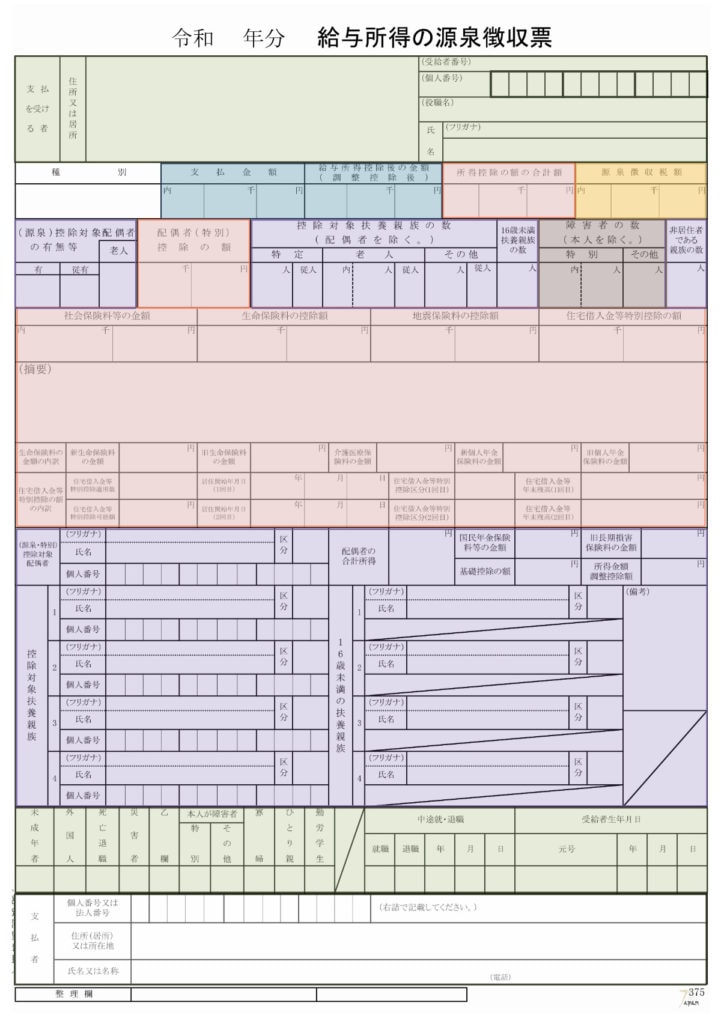

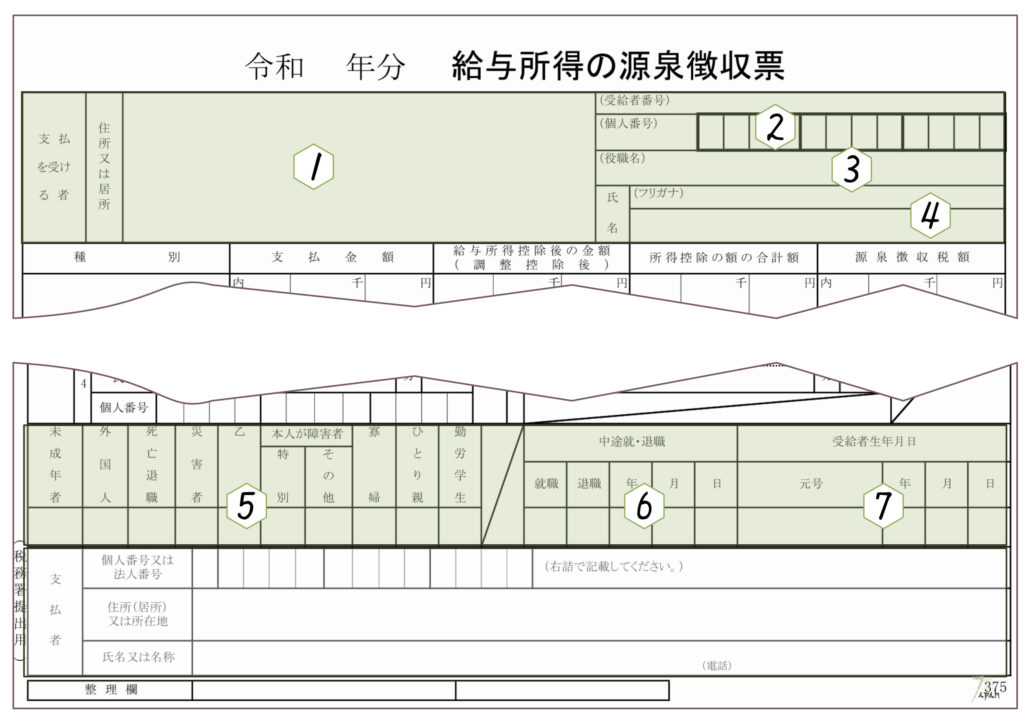

The green sections contain information about you.

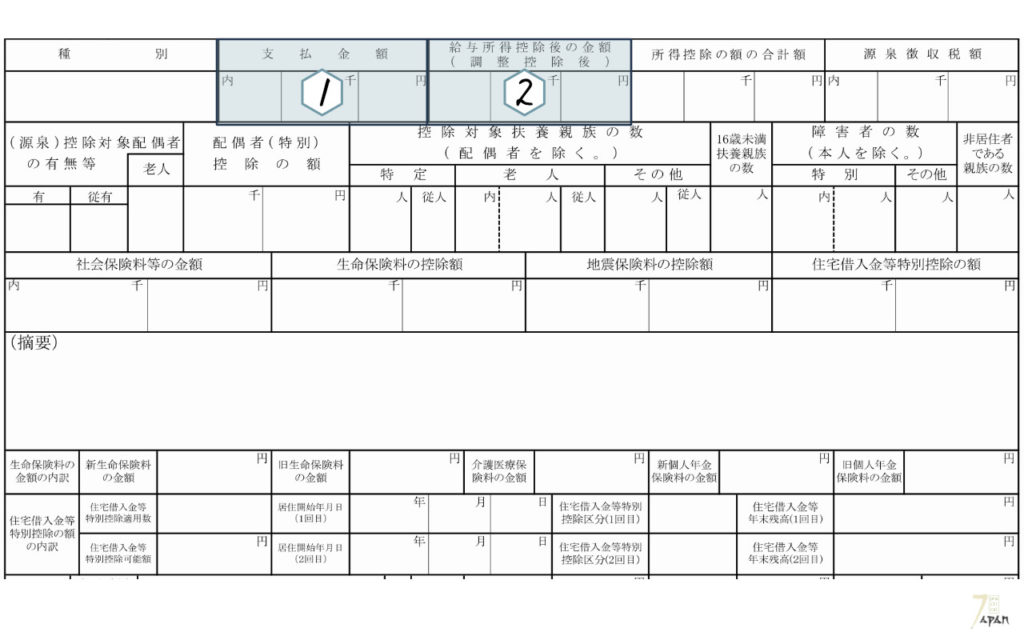

The blue sections shows your income.

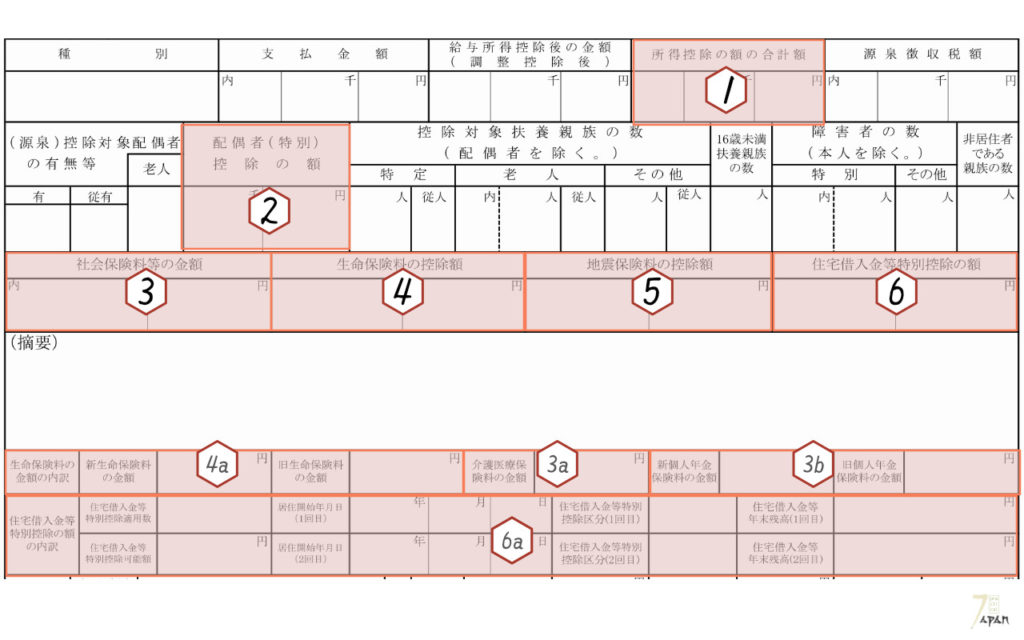

The red sections detail various tax exemptions.

The yellow section is the amount of tax deducted from your salary.

The violet section shows information about your family (dependents).

The brown section lists the handicapped members of your family.

The white section at the bottom contains information about your employer.

Information about the tax payer

Let’s start with the easy part. The top and bottom of the gensenchoshuhyou contain information about the taxpayer (⽀払いを受ける者の住所, in this case: you).

From left to right, you will find:

1) your address;

2) your My Number;

3) name of your position at the company;

4) your name with furigana;

5) information about your status: underaged (未成年), foreigner (外国人), retired due to death (死亡退職), disaster victim (災害者), Section 2 taxpayer (乙欄), handicapped (本人障害者), widow (寡婦), single parent (ひとり親), working student (勤労学生);

6) the date you left the company (if you resigned);

7) your date of birth.

Income

Sections marked in blue relate to your income.

Box 1) shows total employment income you earned during the year from this employer (⽀払⾦額).

Box 2) shows your income after employment income deduction (給与所得控除後の⾦額).

1) Total employment income (⽀払⾦額)

Box 1) shows total employment income you earned during the year from this employer (⽀払⾦額). Employment income in this case consists of salary, wages, bonuses, various allowances, and fringe benefits paid you receive from your employer.

Income-related items exempted from tax

If your employer pays you a transportation allowance to cover your regular commute to work and travel expenses, they would be exempted from tax. For the regular commute, a sum up to a maximum of 150,000 yen per month in case you are using public transportation or up to 31,600 yen per month if you are using a car, bicycle, etc. will not be subject to tax.

“Special allowances” are also exempted from tax. Special allowances include for example entertainment expenses, marriage gifts or gifts on occasion of birth of a child, funeral contributions, condolence payments, consolation money for disasters, benefits for medical treatment or leave compensation.

Fringe benefits, such as meals, uniforms, lease of company residence, awards for long service, discounted sale of merchandise, etc. are usually not subject to taxation.

2) Income after employment income deduction (給与所得控除後の⾦額)

Each year taxpayers are entitled to treating part of their income as “expenses” or “cost of doing business”. The amount of income that will not be subject to income tax depends on each person’s income. For 2020 (Reiwa 2) the calculation table is as shown in the table below (based on data from the National Tax Agency). Box 2) shows your income after the deduction.

| Total income | Deduction for Employment Income |

|---|---|

| less than 1,800,000 yen | total income x 40% – 100,000 yen (or 550,000 yen, whichever is higher) |

| 1,800,000 yen to 3,600,000 yen | total income x 30% + 80,000 yen |

| 3,600,000 yen to 6,600,000 yen | total income x 20% + 440,000 yen |

| 6,600,000 yen to 8,500,000 yen | total income x 10% + 1,100,000 yen |

| over 8,500,000 yen | maximum 1,950,000 yen |

Tax exemptions

The sections marked in red contain information about various other tax exemptions.

Box 1 is the total amount of income deductions (所得控除の額の合計額) including:

- Box 2) spousal exemption (配偶者特別控除の額)

- Box 3) social insurance (社会保険料などの金額)

- Box 4) life insurance (生命保険料などの控除額)

- Box 5) earthquake insurance (地震保険料の控除額)

- Box 6) house loan exemption (住宅借入金等特別控除の額)

- “Basic deduction” (基礎控除) of 480,000 yen in 2020 (same amount for all with total yearly income under 24,000,000 yen, not shown on the gensenchoshuhyou)

- Deductions for family members who are your dependents (see section on family members) if applicable.

- Other special deductions (for example for widows, victims of disasters, people with disabilities, etc.) if applicable.

Boxes in the lower half of the picture give more details about tax exemptions.

- Box 3a) shows the premiums paid for nursing and medical insurance (介護医療保険料の金額).

- Box 3b) shows the premiums paid towards the old individual pensions scheme (旧個人年金保険料の金額).

- Box 4a) details premiums paid towards the new life insurance (新生命保険料の金額) and the old life insurance (旧生命保険料の金額).

- Box 6a) gives more information about home loan exemption (住宅借入金等特別控除の額の内訳).

Tax withdrawn at source

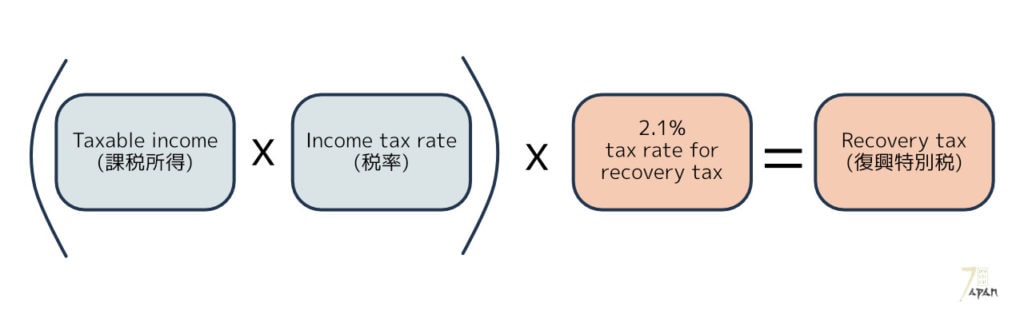

The yellow box shows the amount of tax that was withdrawn at source (源泉徴収税額) by your employer and transferred to the appropriate governmental agencies. The tax withdrawn at source consists of the income tax and a special tax for recovery (復興特別税).

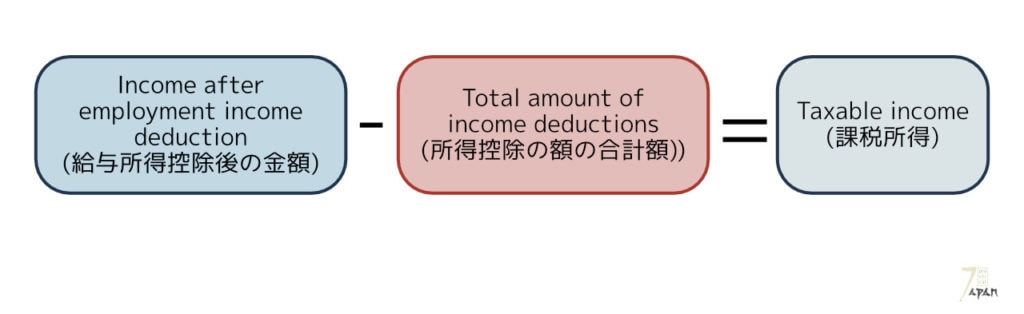

Taxable income

First, we need to find out the actual taxable income (it’s not on the gensenchoshuhyou!). In order to get the taxable income, we need to do the following equation:

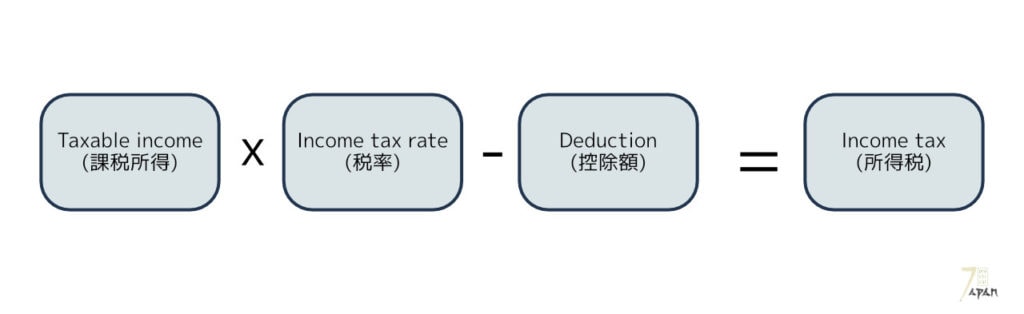

Income tax

Next, we can use the tax rate table provided by the National Tax Agency to calculate the income tax itself. Note that the deduction in the table below is yet another different deduction (not previously mentioned in this article).

| Taxable income | Tax rate | Deduction |

|---|---|---|

| less than 1,955,000 yen | 5% | 0 yen |

| 1,955,000 yen to 3,300,000 yen | 10% | 97,500 yen |

| 3,300,000 yen to 6,950,000 yen | 20% | 427,500 yen |

| 6,950,000 yen to 9,000,000 yen | 23% | 636,000 yen |

| 9,000,000 yen to 18,000,000 yen | 33% | 1,536,000 yen |

| 18,000,000 yen to 40,000,000 yen | 40% | 2,796,000 yen |

| over 40,000,000 yen | 45% | 4,796,000 yen |

The income tax calculation is:

Special tax for recovery

The special tax for recovery (復興特別税) was established to help the recovery efforts after the 2011 disaster.

Information about your dependents (family)

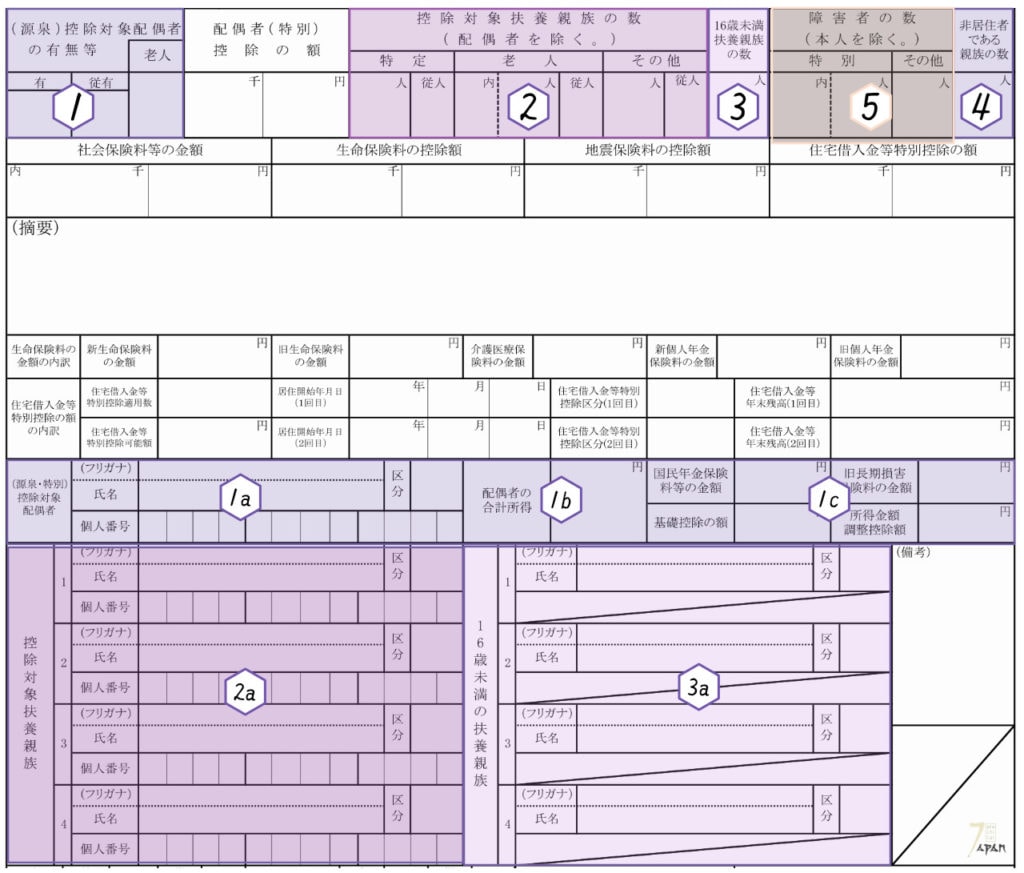

The sections marked in violet describe your dependents.

- Box 1) shows whether your spouse is eligible for spousal tax exemption ((源泉)控除対象配偶者の有無等).

- Box 2) shows number of your family members other than your spouse for whom you are entitled to tax exemption (控除対象扶養親族の数):

- “Specific dependents”, or between 19 and 22 years old (特定) – 630,000 yen exemption.

- Elderly dependents, 70 years old or older (老人) – 580,000 yen exemption if they live with you or 480,000 yen if not.

- Other dependents (16-18 and 23-69 years old) – 380,000 yen exemption.

- Box 3) shows number of children under 16 years old who are your dependents (扶養親族の数).

- Box 4) shows number of relatives who are non-residents (非居住者である親族の数).

- Box 5) shows number of relatives who are disabled (障害者の数) – the exemption amount differs depending on level and type of disability.

Boxes in the lower part of the picture give more details about your dependents.

The first there are three boxes with detailed information about your spouse if they are eligible for spousal exemption.

- Box 1a) contains the spouse’s name and My Number.

- Box 1b) shows the spouse’s total income.

- Box 1c) is devoted to various exemptions your spouse is entitled to.

Boxes 2a) and 3a) contain names and My Numbers of the family members listed in Box 2) and Box 3) respectively.

Disclaimer

This post is intended as an overview of the gensenchoshuhyou. While the author made every effort to ensure the information contained here is accurate, we cannot guarantee the accuracy, currency or completeness of the material contained on this website and accept no responsibility or liability arising from or connected to it. We recommend that you obtain professional advice before making any tax-related decisions.

Please share

If you have found information in this post useful or interesting, please like it or share it on social media. Thanks!

This was immensely helpful – thank you so much for publishing this!

I am glad I could help 🙂