What is Furusato Nozei (ふるさと納税), you ask? It’s the Japanese government’s way to encourage residents to pay taxes and support local governments. But for us, taxpayers, it’s a chance to get something concrete in return for our hard-earned money. Read on to find out more about the tax scheme and how you can benefit.

What is Furusato Nozei?

Furusato Nozei (ふるさと納税), also known as the Hometown Tax, was established in 2008 to support local municipalities through charitable donations.

The donations are tax deductible. This means that Furusato Nozei soon became popular as a clever way to lower your residence tax (住民税, juuminzei). Instead of paying the whole tax to the municipality you are registered at, you can ‘donate’ to any prefecture or municipality in Japan and get a reduction in the amount of tax you have to pay.

As a token of gratitude, local governments offer various goods produced in their jurisdictions as ‘gifts’. In return for the money you have to pay as tax anyway, you can choose a reward from a wide variety of categories, from fruits to electrical appliances to travel vouchers.

Three reasons you should give Furusato Nozei a try this year

1) You get to taste and experience remote parts of the country

Thanks to the Furusato Nozei scheme, you can access unique products from all over Japan. Food, clothes, accessories, traditional craft items, electrical goods, everyone can find something interesting. And if you are more into travel, some municipalities offer vouchers you can use at local hotels, restaurants and shops. Recently, crowdfunding style projects are gaining popularity as well.

2) You get to make a contribution to your favourite municipality

The original reason behind the Furusato Nozei program is to support villages, towns and cities all over Japan through charitable donations. You can even choose how the recipient should use your donation. Usually there are several options including disaster relief, educational projects, promotion of tourism, infrastructure improvement projects, etc.

3) You get to pay a lower tax next year

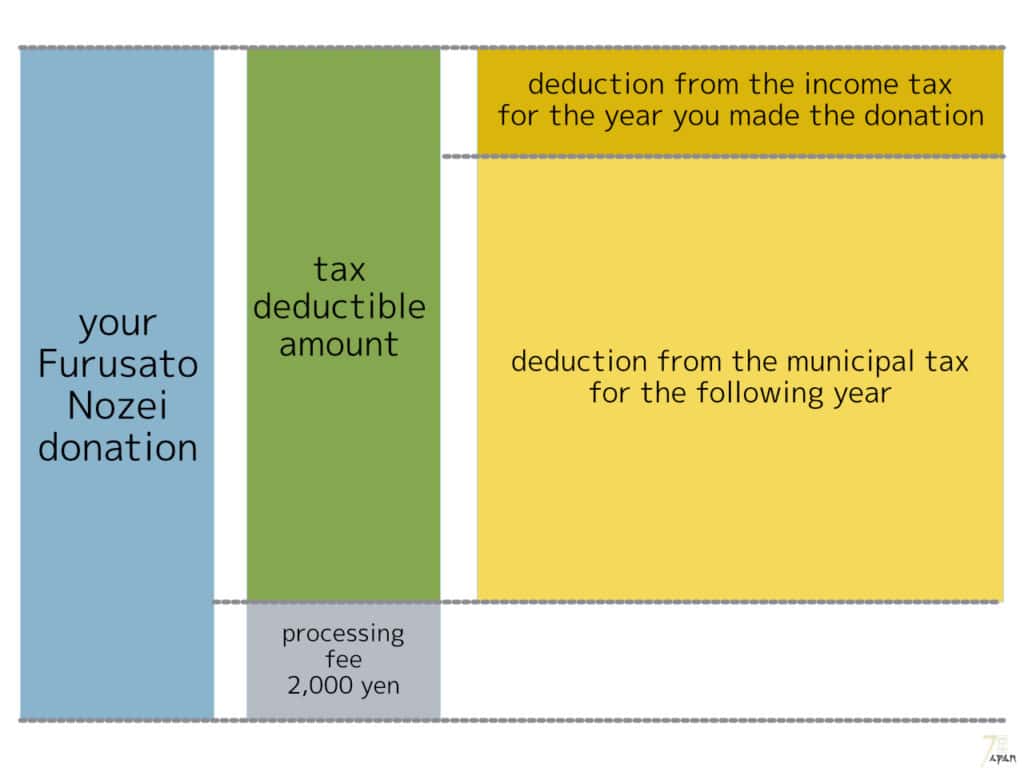

The donations you make affect the amount of income tax and residence tax you have to pay. Depending on how much you donate and on your household’s income, you may be able to claim back a large percentage of the donation.

How the tax deduction works

Income tax deduction

Part of your Furusato Nozei donation (minus 2,000 yen processing fee) will be deducted from the income tax you are due to pay the same year you made the donation. You can calculate the exact amount with the following equation:

(donated amount – 2,000 yen) x income tax rate

However, there is a catch: the maximum amount of donation that is tax deductible is 40% of your total net income (総所得金額).

Residence tax deduction

Your residence tax deduction will be applied to the tax you are due to pay the year following the year you made the donation. The deduction comes in two parts, the ‘basic exemption’ (基本控除) and the ‘special exemption’ (特例控除).

The basic exemption is equal to

(donation – 2,000 yen) x 10%.

Again, there is a cap on how much of the donation is tax deductible. Here, it is 30% of your total net income.

There are two ways of calculating the special exemption.

1) if the income-based part of your inhabitant tax does not exceed 20%:

(donation – 2,000 yen)x (100% – 10% – income tax rate)

2) if the income-based part of your residence tax exceeds 20%:

(residence tax per-income levy amount) x 20%

The above is just a general rule. If you want to know how the deductions determined in your particular case, contact your local tax office.

How to donate and get your Furusato Nozei gifts

Foreign residents are eligible to take part in the Furusato Nozei program if they pay residence tax in Japan. Read on for some tips on the procedure.

1. Estimate the amount of donation you should make

The amount of donation you should make to benefit from the program but not overpay for the ‘gifts’ depends mainly on

- your income for the year,

- the tax deductions you have because of your social security premiums payment, etc.

- and on the municipality you are registered at.

There are many online ‘simulators’ that can give you a more or less accurate estimate. Some simulations take into account only on the size of your household and your income. For a more accurate result, you will need to give details of your income, health insurance and pension premiums, etc. Most simulations recommend that you refer to a gensenchoshuhyo or a kakutei shinkoku receipt for the previous year.

However, if you need an exact number, or if you want to make sure your donation will count, your best bet is to ask your municipality’s tax office for advice.

2. Choose the ‘gifts’ you want

Most Japanese people use aggregator sites to search for interesting gifts and make their donations. Furunavi, Furusato Choice, Satofull, and Rakuten are among the biggest and most popular. The catch is that almost all such sites are Japanese-only.

If you would rather deal directly with your chosen municipality, your best bet is to head to their official website and see what they have on offer and what is the exact procedure to follow.

3. Make your donation and get the gift

The cutoff date for donations is December 31st. Most Japanese people start thinking about Furusato Nozei around October or November – by that time they can more or less guess their income for the year!

The process is almost the same as for regular online shopping. Choose your preferred gift, add it to the shopping cart, check out and make your payment. You can donate to as many places as you want (remember the tax exemption limit, though).

The key here is to make sure you input your name as on your residence card and your officially registered address. This is so that the municipality you donate to can prepare the paperwork for you.

Most places let you choose the place your gift will be delivered to (it does not have to be your registered address). You can even send the gift as a present to someone straight from the Furusato Nozei websites.

Usually your gift will arrive within a week. However, some seasonal goods such as fruit may have a set time limit for orders and a specified delivery period. Some municipalities offer a ‘subscription model’ – donate once, and the municipality will send you a portion of your chosen gift every month or week. I find this works well with meat and seafood sets.

4. Fill out and send back the paperwork

Together with your gift, you will get a receipt form. You will need the receipt when you do your year-end taxes (kakuteishinkoku).

If you are a salaried employee and do not have to file a year-end tax return, or if you have donated to up to 5 different municipalities in one calendar year, you are eligible to use the One Stop Nozei system. This means that the municipalities you donated to will contact your municipality and inform it about the donations.

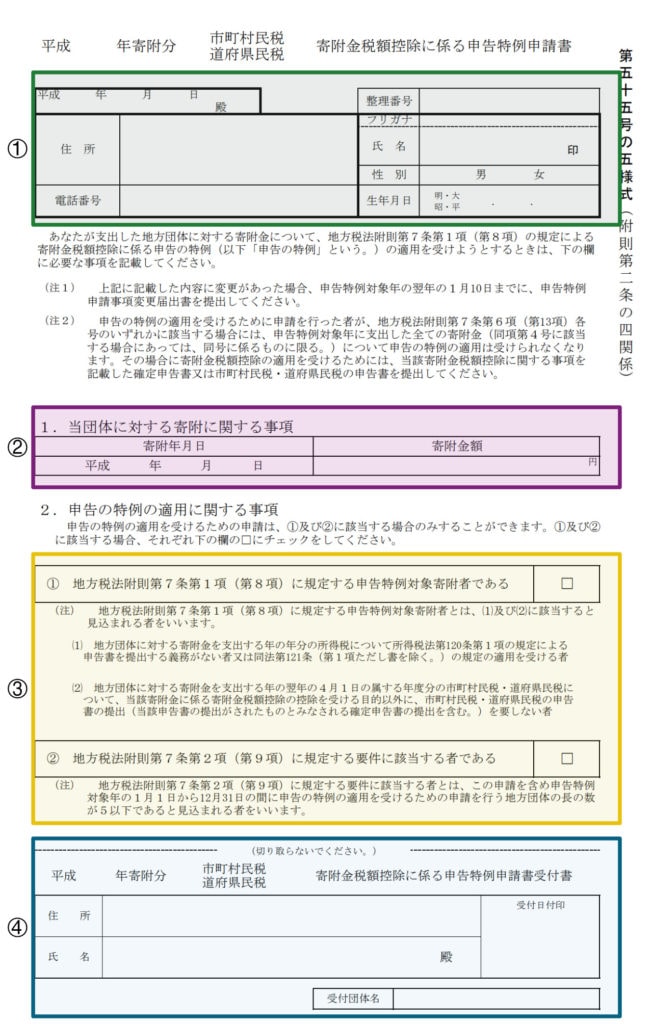

You will need to fill out the form you received together with the gifts and send back a copy of your my number card or a set of other ID documents to prove your identity. You can also download the form from the Ministry of Internal Affairs and Communication website.

Fill out the top part of the form ① with your address, name, sex, date of birth and phone number. Put the date you fill out the form in the top left box and write the name of the municipality you donated to.

Write the date and the amount you donated to the municipality ②.

To use the One Stop Nozei scheme, you need to fulfill certain conditions listed in ③. If you do not have to pay income and residence taxes for the year, check the first checkbox. If you have to pay taxes, but donated to up to 5 different municipalities, check the second checkbox.

The municipality you donated to will send back the last part of the form with a stamp ④ to let you know they have processed your request.

Useful links

Official Furusato Nozei website of the Ministry of Internal Affairs and Communication (Japanese)

One Stop Nozei application form

Please share

If you have found information in this post useful or interesting, please like it or share it on social media. Thanks!