Juminzei (住民税) is also known as resident tax, residence tax, inhabitant tax. It is one of two taxes levied on individuals living in Japan (the other is the income tax or shotokuzei 所得税). Juminzei is the part that goes to the local government (the prefecture, city or town) you reside in.

What is the juminzei?

Juminzei is an umbrella name for two taxes levied on the individual:

- the prefectural resident’s tax

- the city/town/village resident’s tax.

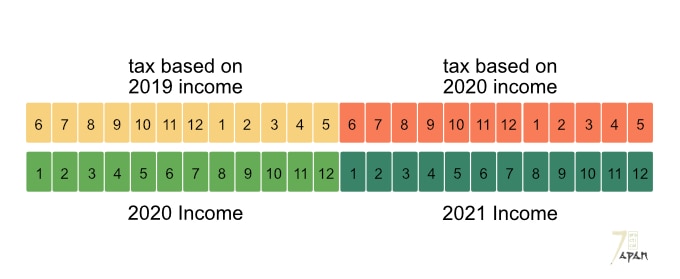

The local government decides how much you need to pay based mostly on your income the previous year and notifies you of the amount around June.

It helps cover the cost of administrative services provided to residents on the prefectural and city/town/village levels.

Who does the juminzei go to?

Your juminzei will go to the municipality (prefecture and city/town/village) you have registered your juminhyo (住民票, residence certificate) as of January 1.

If the place you actually live and the address you have officially registered are different, you will pay the tax to the municipality where your official residence was as of January 1.

What if you change address during the year?

If you move to another municipality after January 1, you will continue paying the juminzei to the municipality you were residing in as of January 1.

How much is the juminzei?

The amount of juminzei you will actually pay depends on your taxable income the previous year.

If you made donations under the furusato nozei (故郷納税, or hometown tax) scheme, you may get a lower juminzei.

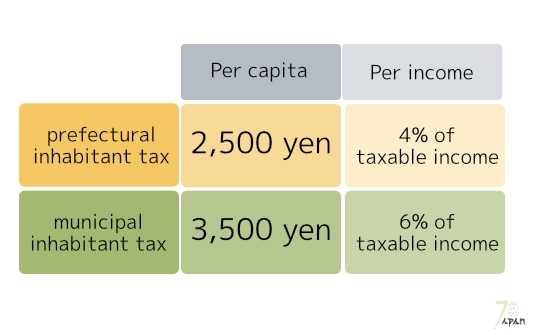

The juminzei comprises two parts: an income ratio amount and a per capita amount.

- If you live in a municipality on or as of January 1, pay both parts of the tax.

- If you don’t live in a municipality but have an office, business or property there on or as of January 1, pay only the per capita part of the tax.

A prefectural and/or municipal government may levy an additional fixed amount per capita for disaster prevention measures.

For example, in the 23 wards of Tokyo juminzei is:

- prefectural residence tax (kenminzei, 県民税, or tominzei 都民税): 4% of taxable income and 2,500 yen,

- municipal inhabitant tax (shichousonminzei, 市町村民税): 6% of taxable income and 3,500 yen.

Deductions from income

There are various deductions you can make when you calculate your taxable income.

For example, in Tokyo there are deductions for casualty losses, medical expenses, social insurance premiums, life insurance premiums, earthquake insurance premiums, deduction for persons with disabilities, for widows and widowers, for working students, a deduction if you are supporting a spouse and/or dependents, housing loan deduction, etc.

Deductions from taxes

There are further deductions in case of

- dividend income,

- capital gain from shares, etc.,

- income earned in a foreign country.

The local government specifies how much of the income you can deduct.

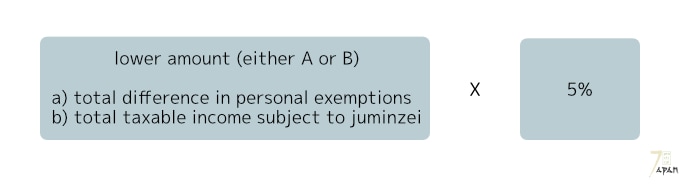

Adjustment deduction

Adjustment deduction was introduced to compensate for differences between the amount of exemptions from income tax and juminzei.

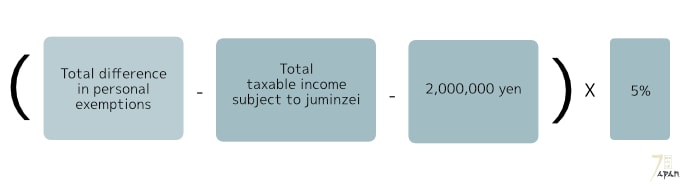

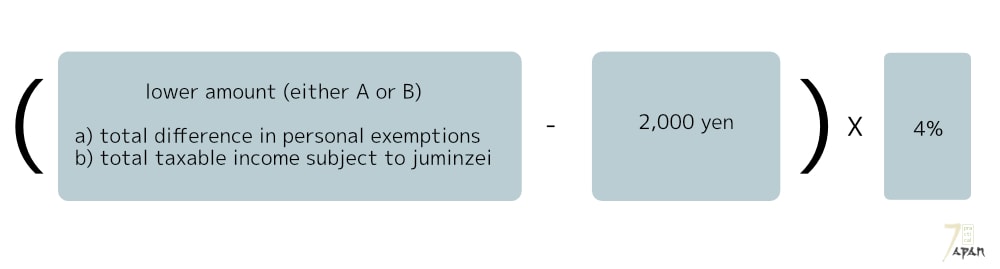

In Tokyo, it is calculated in the following way:

a) If your taxable income subject to juminzei is 2,000,000 yen or less:

b) If your taxable income subject to juminzei is over 2,000,000 yen:

Tax deduction for donations

If you have made a donation exceeding 2,000 yen to a local government through the furusato nozei (hometown tax scheme) or to organizations specified by your municipality, you can deduct a certain portion of your income.

There are two methods of calculating deductions in the Tokyo area:

- Standard deduction (used for all types of donations)

- Special deduction (used for the furusato nozei donations).

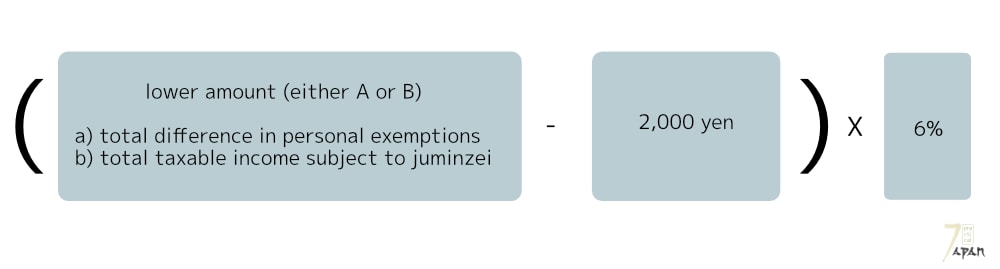

Standard deduction

In case of the prefectural tax:

In case of the municipal tax:

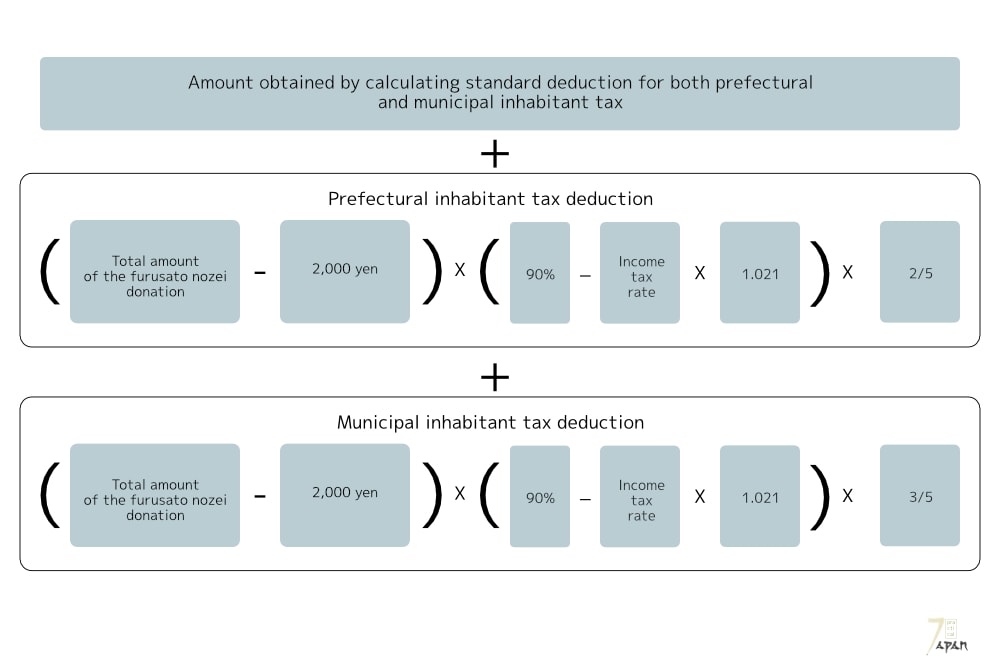

Special deduction

If you made a donation through the furusato nozei scheme, the deduction is calculated in the following way:

However, the deduction for furusato nozei donations is capped at 20% of the per income levy of the inhabitant tax

Who has to pay the juminzei?

Anyone who lives in Japan as a resident as of January 1 and earns over 1,000,000 yen per calendar year.

You will not have to pay juminzei in the first year you arrive in Japan, because you did not have an income in Japan the previous year. If you are still in Japan in January the following year, you will have to pay the juminzei.

Filing for inhabitant tax return

You should declare your income for the previous calendar year (from January 1 to December 31) to the local municipality where your official residence is as of January 1.

However, in the following cases, you don’t have to submit the declaration:

- if you have filed the final income tax return (kakutei shinkoku, 確定申告)

- if your only income is from employment and public pension and you have submitted a report of payment to the municipality in which you reside.

If you wish to receive deductions for medical expenses or casualty loss, etc. you may need to file for the inhabitant tax return.

Exemptions from taxation

In some cases you may be exempt from paying the per income and/or per capita parts of juminzei.

For example, in the 23 wards of Tokyo, you do not have to pay juminzei (both the per income and per capita parts):

- If you receive public aid and livelihood assistance

- If you have disabilities, are a minor or a widow/widower and your total annual income the previous year did not exceed 1,250,000 yen (2,044,000 yen for employment income recipients)

- If your total annual income in the previous year did not exceed the amount established by ordinances of your local government

You do not have to pay the per income part of the juminzei in the Tokyo’s 23 wards:

- If you do not have a spouse/dependents who share the same household income and your net income for the previous year was less than 350,000 yen

- If you have a spouse/dependents who share the same household income and your net income for the previous year was equal or less than the sum resulting from the following equation:

350,000 yen x Total number of people sharing the same household income + 320,000 yen

Juminzei in case of part-time work

Income you have earned from part-time work is treated as income from salary.

In the 23 wards of Tokyo, if you earned 1,000,000 yen or less annually, you do not need to pay the juminzei.

This may differ depending on the municipality you live in, so it’s best to inquire at your local city or tax office.

How to pay the juminzei?

There are two ways you can pay the juminzei:

- The special collection (deduction from salary)

- The ordinary collection

Special collection

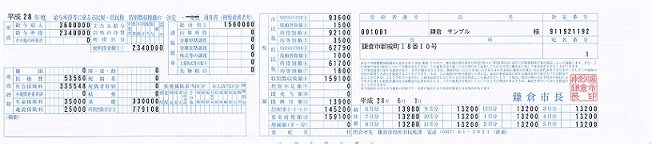

Your employer may deduct the juminzei for the period from June 1 to May 31 from your salary and pay it to the local government. Your employer will notify you of the tax amount also by May 31.

If you change jobs, your new employer will take over and deduct the juminzei for you.

If you quit your job, your local government will send you the tax invoices for the remaining amount and you will have to pay juminzei by yourself.

If you receive a retirement pension, your juminzei will be automatically deducted from the pension each month.

Ordinary collection

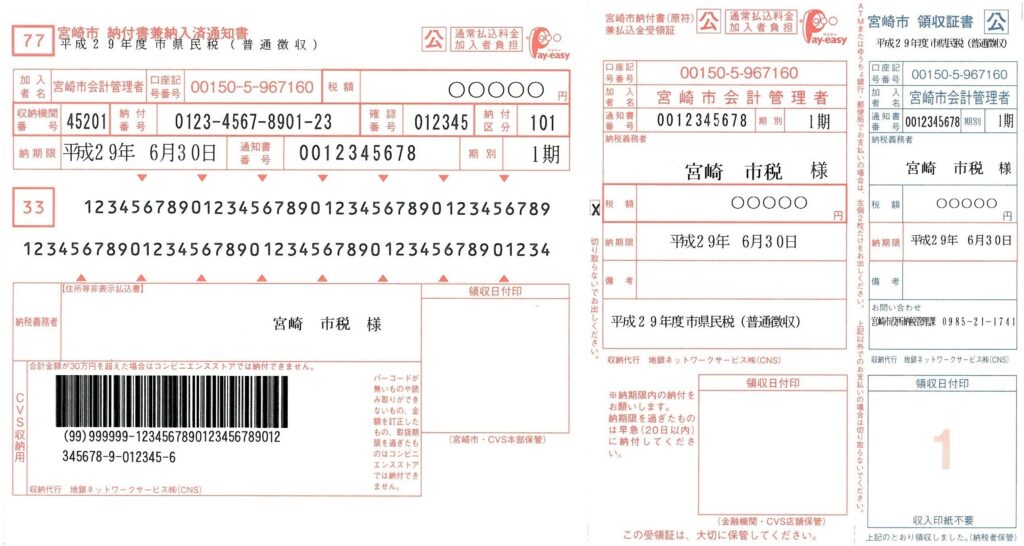

In most other cases, you will receive invoices or a Tax Notice (nofusho, 納付書) from your local government which you will then pay by yourself. You may choose to pay in one lump sum or split the bill into four installments payable throughout the year in June, August, October and January.

You can pay

- at the convenience store,

- at your bank office,

- at the ATM using the Pay-easy function,

- via internet banking,

- at the municipal office or tax office,

- at the post office,

What if you have to leave Japan?

If you had income the previous year, you will need to pay the tax even if you permanently leave Japan after January 1. If you plan to leave Japan, make sure you pay all the outstanding amount of juminzei.

If your employer is deducting the juminzei for you from your salary, ask them to deduct the due amount in one lump sum. If you pay by yourself – inform your city office that you wish to pay the tax in one go before you leave.

Useful links

Guide to Metropolitan taxes 2020

Information for Taxpayers – National Tax Agency

2020 Income Tax and Special Income Tax for Reconstruction Guide – National Tax Agency

Disclaimer

The information provided on this website is intended for informational purposes only and should not substitute for a lawyer or a tax adviser. This information does not constitute legal advice. The information is provided “as is” without warranty of any kind, either expressed or implied, including, but not limited to the implied warranties of merchantability, fitness for a particular purpose or non-infringement of third party rights.

Please share

If you have found information in this post useful or interesting, please like it or share it on social media. Thanks!