The one thing you cannot escape regardless of the place you live in is TAXES. Early spring (January-April) is the tax season in Japan. As a resident you are expected to pay the income tax (shotokuzei, 所得税) based on your income in Japan for the previous year (from January 1 to December 31). How to go about it? If you have been here for a while, you have probably heard about nenmatsu chōsei and kakuteishinkoku.

If you were employed by only one company during the year, your employer will usually take care of most of the filing and payment for you in a process called nenmatsu chōsei (年末調整, literally “year-end adjustment”). However, if you had multiple employers or left your company before the year ended, you will have to do your taxes by yourself. This is kakuteishinkoku (確定申告, “final declaration”).

Why do you need kakuteishinkoku?

Most employers will deduct a set amount from your salary towards the income tax each month (that’s called the gensenchōshū (源泉徴収, “tax withheld at source”) and give you a document to certify how much deductions totaled for the year (gensen chōshū hyō) in January. So, why do you need to file the final income tax return at the end of the year?

Through kakuteishinkoku you inform the government about all the income you have had during the year and about the tax-deductible expenses you’ve had (such as the health insurance and pensions payments or a house loan) so that the final amount of income tax you have to pay can be adjusted.

Who has to file the income tax return?

You will have to do kakutei shinkoku:

- if your salary was more than 20,000,000 yen

- if your employer is not doing the nenmatsu chōsei for you

- if you have more than one source of income (multiple part-time jobs, freelancing, investment, etc.)

- if you have one main job but your other annual income exceeds 200,000 yen

- if you leave Japan before the end of the year

How to do your kakuteishinkoku?

Filing your first kakuteishinkoku can be a daunting task, but don’t worry – I have you covered!

Where should you go to file your tax return?

There are three ways to file your tax returns:

- in person at your local Tax Office

- through mail to your local Tax Office

- online through e-Tax system (there is some explanation in English)

Many Tax Offices offer consultations and have staff on hand to help you fill out the tax forms during the tax filing period (usually mid-February to mid-March). If this is your first time doing the kakutei shinkoku, I would recommend going in person and taking advantage of the free advice. Some municipalities also offer consultations in foreign languages.

What are the necessary documents?

There are a couple of documents you will need to file the income tax returns.

- your ‘My number’

- an ID card (residence card or plastic ‘My number card’ works best)

- a bank book or card

- the tax forms

- documents proving deductible expenses

- documents proving your income (such as gensenchoshu-hyo from your employers)

How to fill out the tax return forms?

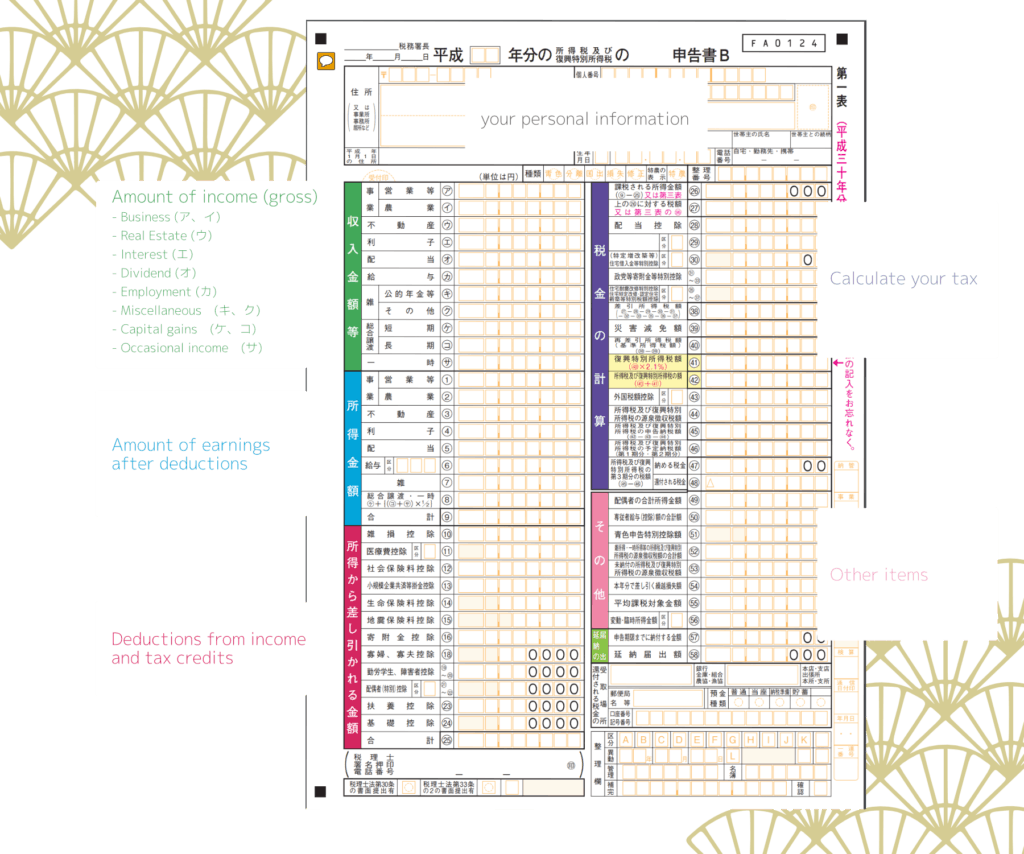

There are two types of forms available:

Form A – if you only have income from employment or pensions, dividend, occasional income, etc. and you don’t have any estimated tax prepayment

Form B – can be used regardless of the type of income

If you are self-employed or freelancing, consider registering your business and using the ao-iro shinkokusho (青色申告書, “the blue tax form”). This will let you take advantage of various tax deductions.

You can generate and fill out the forms online through e-tax or download them from the National Taxation Agency website. The form has a number of color-coded sections where you can put your personal details, information about your employer(s) or your own business(es) and the income you’ve had from various sources. There is even a handy guide in English to help you navigate the forms!

How to pay the income tax?

If you need to pay the income tax, there are various payment options available:

- automatic transfer from your bank account. In order to use this method, you will have to apply by submitting an “Application (notification of change) for tax payment by transfer account” form to your local Tax Office or your bank by March 16. The tax will be transferred at the end of April.

- payment using e-Tax

- payment with a credit card through the “National tax credit card payment website”

- payment in cash at the convenience stores, banks, post offices and Tax Offices

Useful links

2023 Income Tax and Special Income Tax for Reconstruction Guide

E-Tax system – Information in English

Disclaimer

This post is intended as an overview of the kakuteishinkoku procedure. While the author made every effort to ensure the information contained here is accurate, we cannot guarantee the accuracy, currency or completeness of the material contained on this website and accept no responsibility or liability arising from or connected to it. We recommend that you obtain professional advice before making any tax-related decisions.

Please share

If you have found information in this post useful or interesting, please like it or share it on social media. Thanks!