What is shoubyouteate

Injury and Sickness Allowance (傷病手当, shoubyouteate) is a system set up to secure the livelihood of the insured person and their family when the insured person cannot work because of sickness or injury and does not receive sufficient remuneration from their employer. If you are enrolled in a health insurance program through your employer, your insurance company will pay shoubyouteate. These benefits are voluntary under the law in case of the National Health Insurance Scheme, but most of the National Health Insurance Associations provide them – if you are not sure yours does, ask at your local city or ward office.

Who is eligible?

To receive shoubyouteate you must fulfill several conditions:

1) Be insured

Only those people who are enrolled in a health insurance scheme through their employers or through the National Health Insurance are eligible. However, sometimes you can continue receiving shoubyouteate even after you have lost your insurance qualification.

Shoubyouteate through company insurance will usually not be paid to a person who was an “insured person with optional and continued coverage” (任意継続被保険者) – someone who opted to extend their insurance through their employer after termination of employment – when they suffered or contracted the injury or sickness.

2) Be absent from work because of an injury or illness not suffered or contracted in the course of employment

Injuries and sickness suffered or contracted in the course of employment and during commute to/from the workplace (those cases covered by the Workmen’s Accident Compensation Insurance) and cases that are not considered sickness (cosmetic surgery, etc.) are not covered by the Injury and Sickness Allowance.

3) Be unable to work

Your ability to work is assessed based on the opinion of healthcare professionals in charge of your treatment and taking into account the contents of your work.

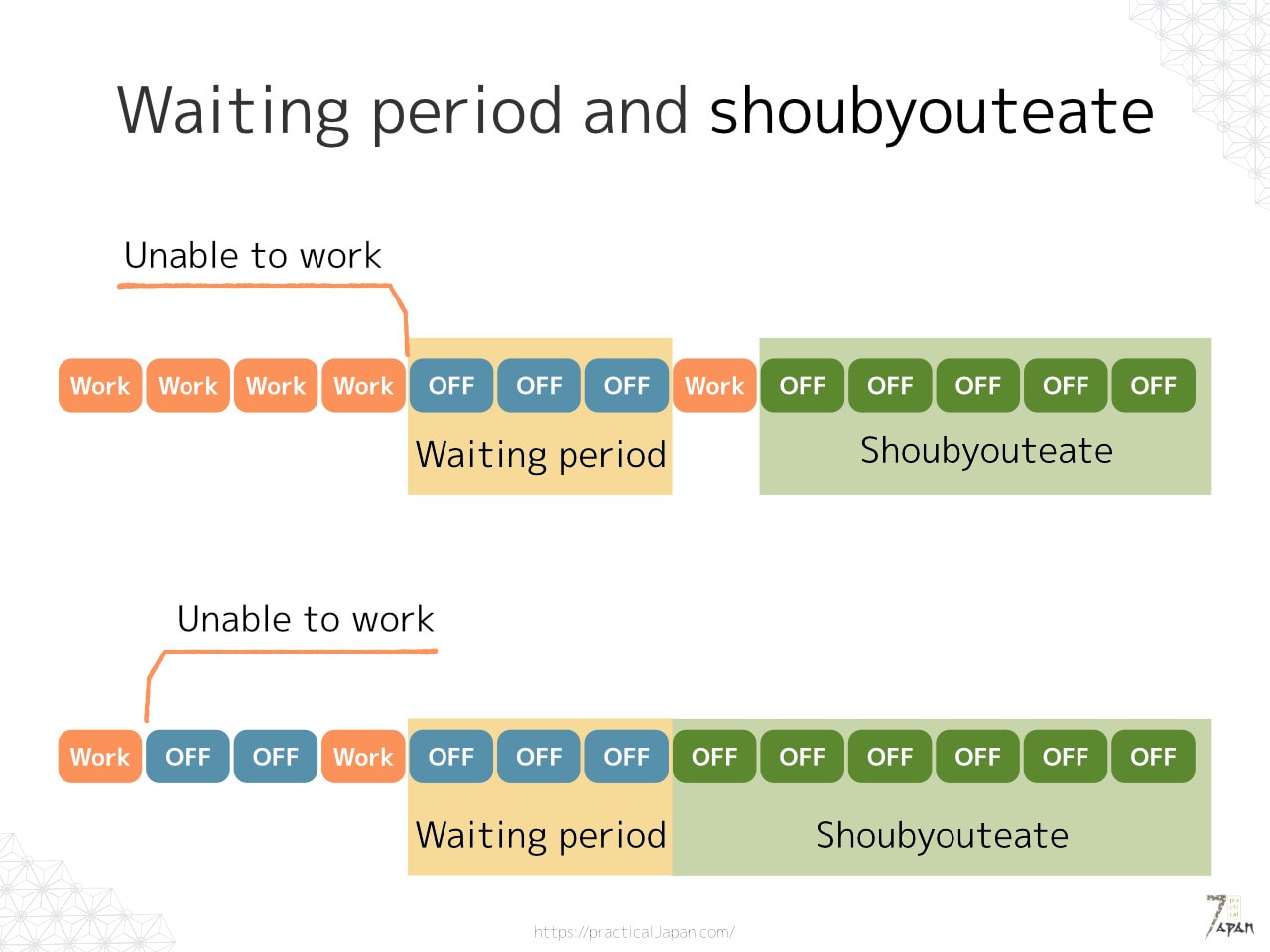

4) Cannot work for 4 or more days

Before the shoubyouteate payments can start, there is a “waiting period” of 3 consecutive absent days. Basically, the Allowance will be paid for the 4th day of absence from work after 3 consecutive absent days. Paid leave, weekends, public holidays are also included in the “waiting period” and it does not matter if you have received salary during that period. The day on which you became unable to work be considered the first day of the “waiting period”.

5) Not receive remuneration during the absent period

If you are receiving salary during the period you are absent from work because of injury or sickness, you not eligible to get shoubyouteate. However, if the salary you receive is smaller than the amount of the Allowance, your insurer should pay out the difference.

Similarly, if you are receiving:

– maternity allowance,

– pension,

– disability pension,

– disability allowance,

– compensation from Workmen’s Accident Compensation Insurance,

and the daily amount is lower than what you would get from shoubyouteate, you will not receive the whole shoubyouteate but the difference between the above and shoubyouteate will be paid out to you.

How much money can you receive?

Insurers usually calculate the amount of shoubyouteate you will receive per day in the following manner: 60% of average monthly salary received over the last 12 consecutive months preceding the receipt of the Allowance divided by 30. The actual method of calculation may differ between insurance companies.

If your employment period is shorter than 12 months

In case the period before the receipt of the Allowance is shorter than 12 months, your insurer will pay the lower sum calculated using methods listed below.

a) average standard monthly salary in the month preceding the first month in which you will receive the Allowance will,

b) average standard monthly salary.

If your employment period is 12 months or longer

In case the period before you start receiving shoubyouteate is 12 months or longer, the average monthly salary for the 12 months preceding the first month the Allowance is paid will be calculated.

For example, if you earned 260,000 yen for 5 months and then 300,000 yen for 10 months preceding the receipt of the Allowance:

(260,000 yen x 2 months+300,000 yen x 10 months) ÷ 12 months ÷ 30 days x 2/3 = 6520 yen (daily amount to be paid)

How to apply

Application process and necessary documents vary between insurers. You will need:

– an application form (often available on the website of your insurer),

– copy of your my number (the plastic my number card or the green notification card and an ID document with picture),

– doctor’s opinion (意見書).

The form is usually a couple of pages long. There is a part for you and parts for your doctor(s) and employer(s) to fill out. Your employer will specify how many working days you missed and how much your regular salary is. Your doctor will give details about the illness/injury and treatment you have received.

If you have changed insurers within the last 12 months, you may have to fill out an additional document to indicate who your past employers were.

Some people apply after they have recovered and can go back to work. Others submit the application form to their insurance companies every month or every couple of months, depending on their financial situation. The right to claim health insurance benefits expires in two years, so if you have had a period you could not work because of sickness or injury, make sure to apply within 2 years.

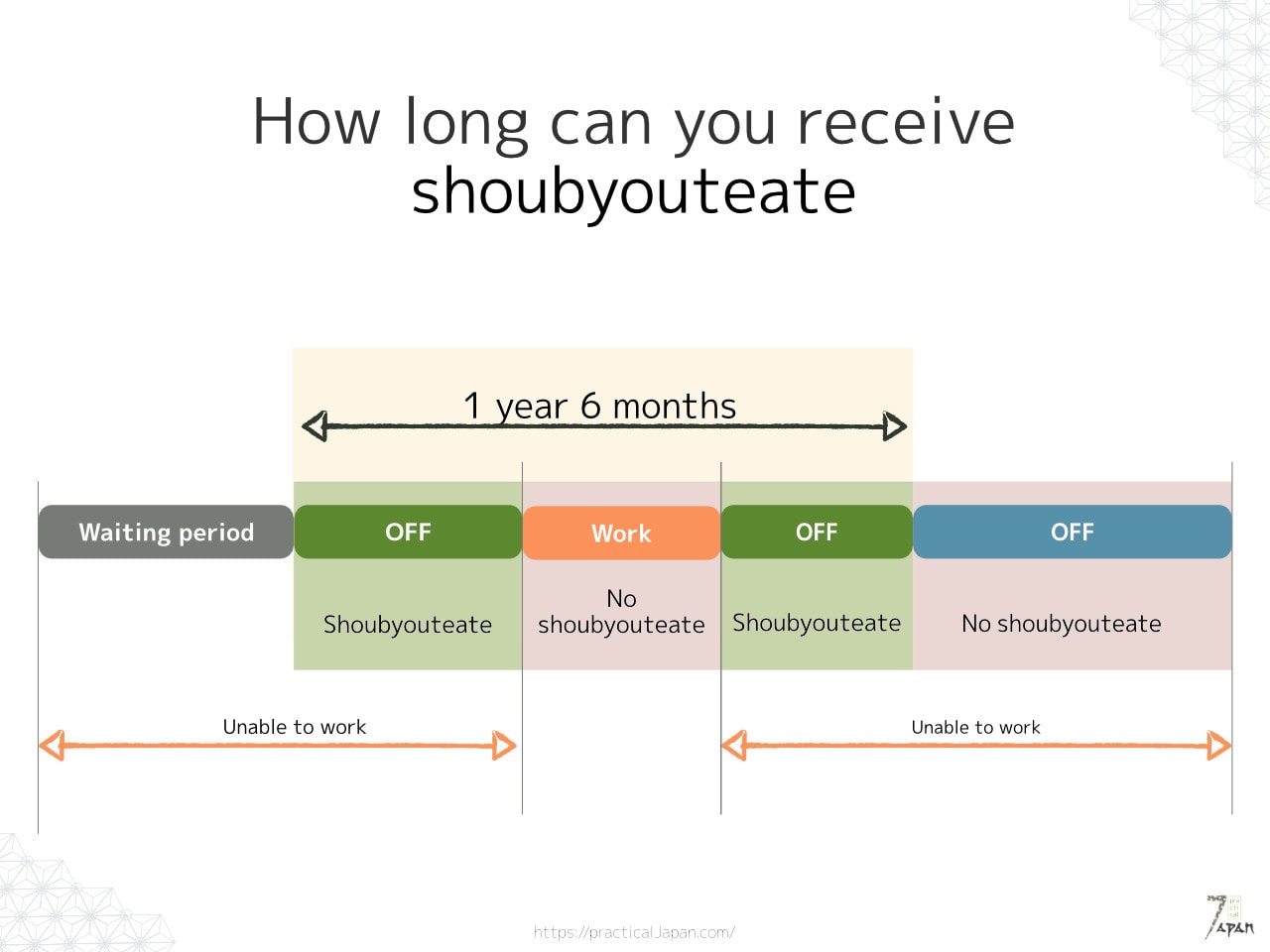

How long can you receive shoubyouteate?

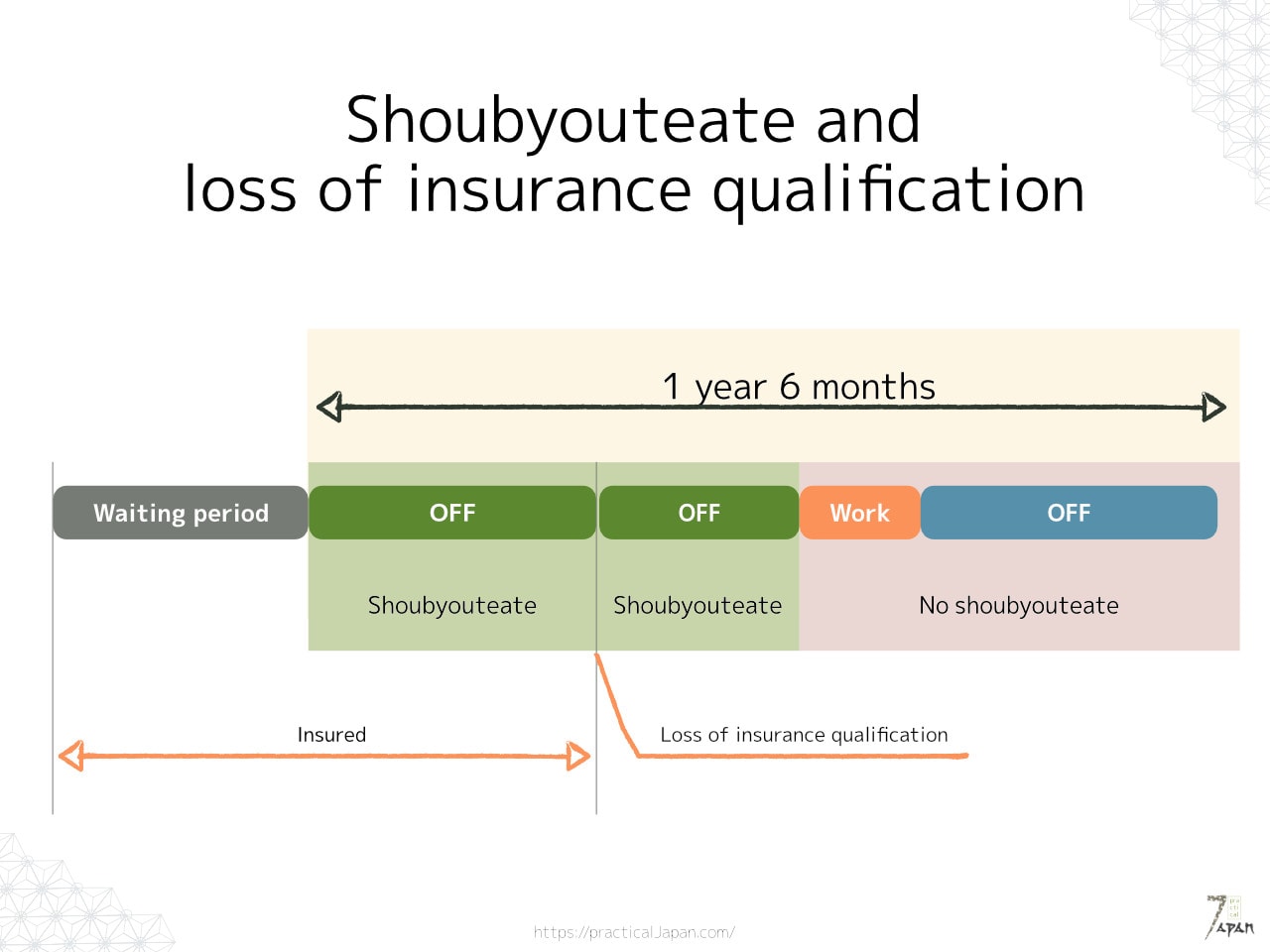

Unfortunately, there is a time limit to how long you can receive shoubyouteate. Your insurer will pay the Injury and Sickness Allowance for a period no longer than 1 year and 6 months. However, this does not mean that you can get the Allowance for every day during the 1.5 years.

If you are absent from work because of injury or sickness, then resume work, and after a while become unable to work again, the period when you were working would also be included in the 1.5 years but the Allowance would not be paid for the time you are working.

Even if you still cannot return to work after the 1.5-year period, your insurer will not pay shoubyouteate for further absence from work.

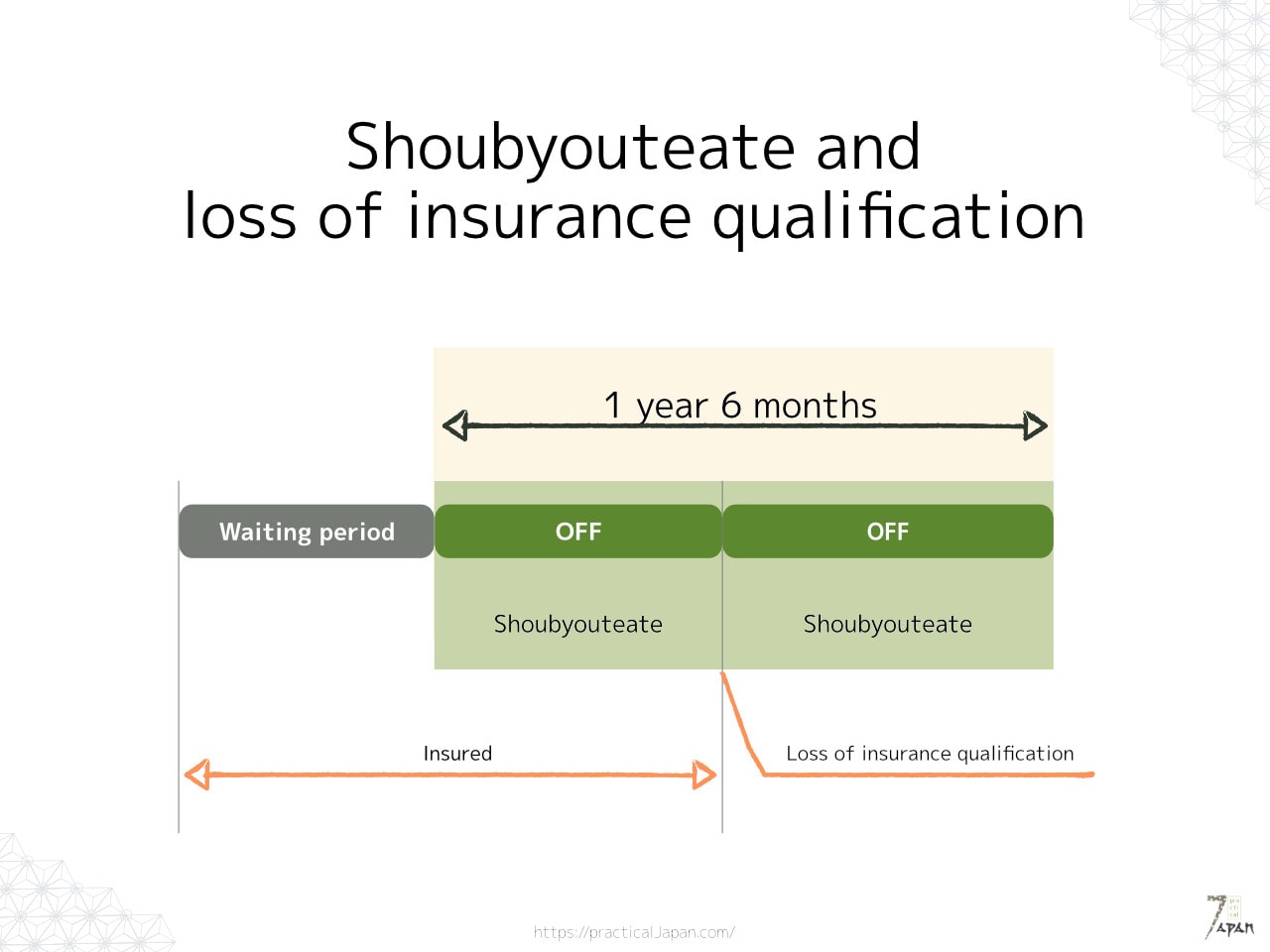

What happens if you lose insurance qualification?

If you have lost insurance qualification, for example, when you retire or leave your current company, you can continue receiving shoubyouteate if you fulfill the following conditions:

– you have been insured for a period longer than consecutive 12 months counting from the day before the loss of insurance qualification

– if you have been receiving the Allowance until the day before the loss of qualification

– you have fulfilled the conditions for receiving shoubyouteate before losing insurance qualification.

However, if you could temporarily return to work after having lost the insurance qualification, the Allowance will not be paid even if the situation changes and later become not able to work.

Please share

If you have found information in this post useful or interesting, please like it or share it on social media. Thanks!